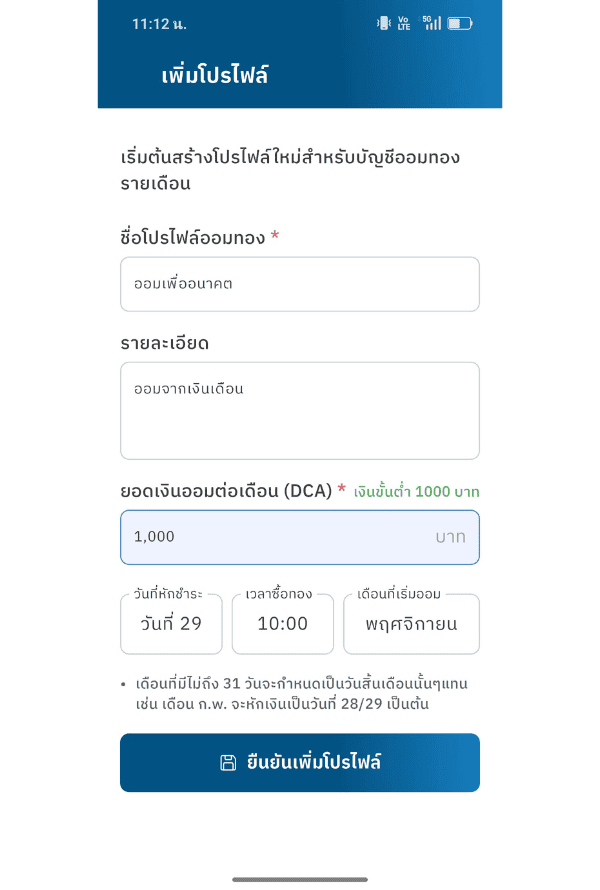

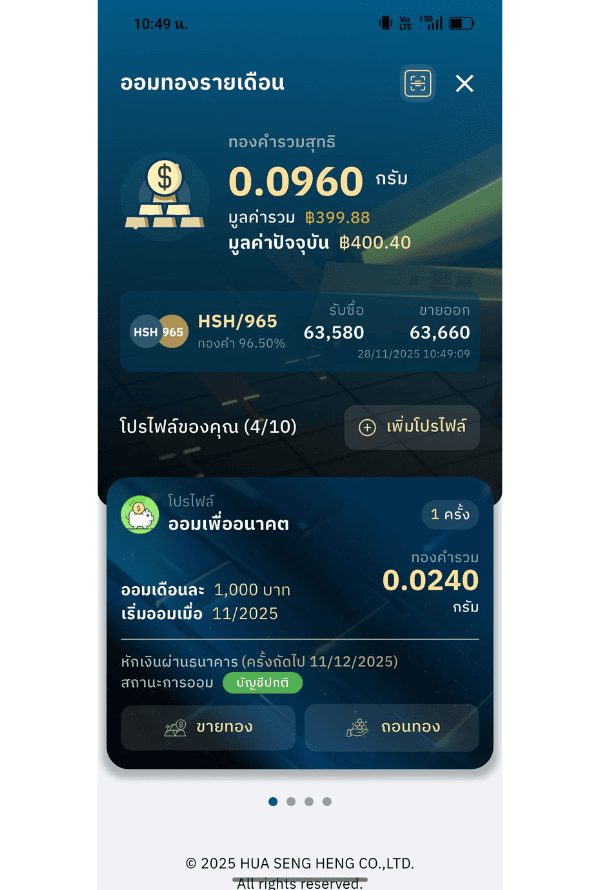

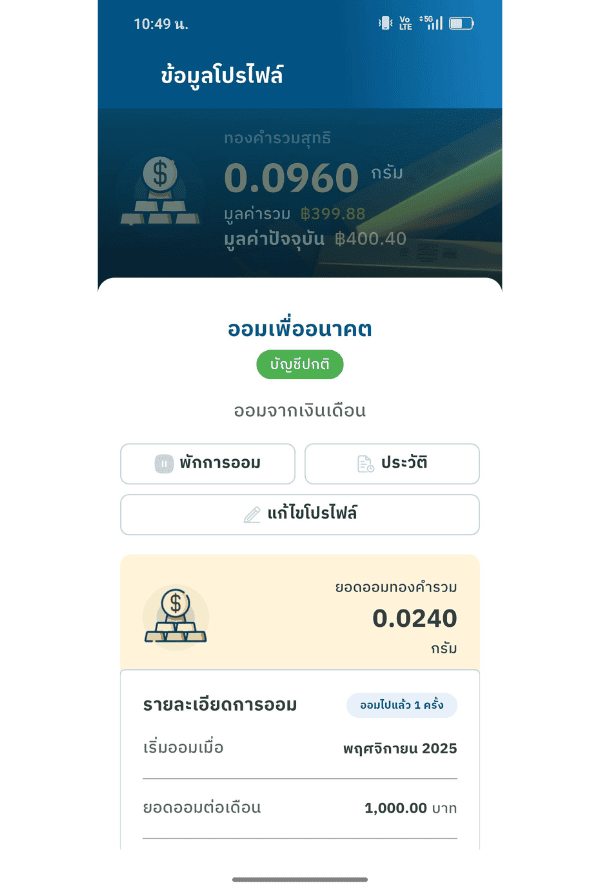

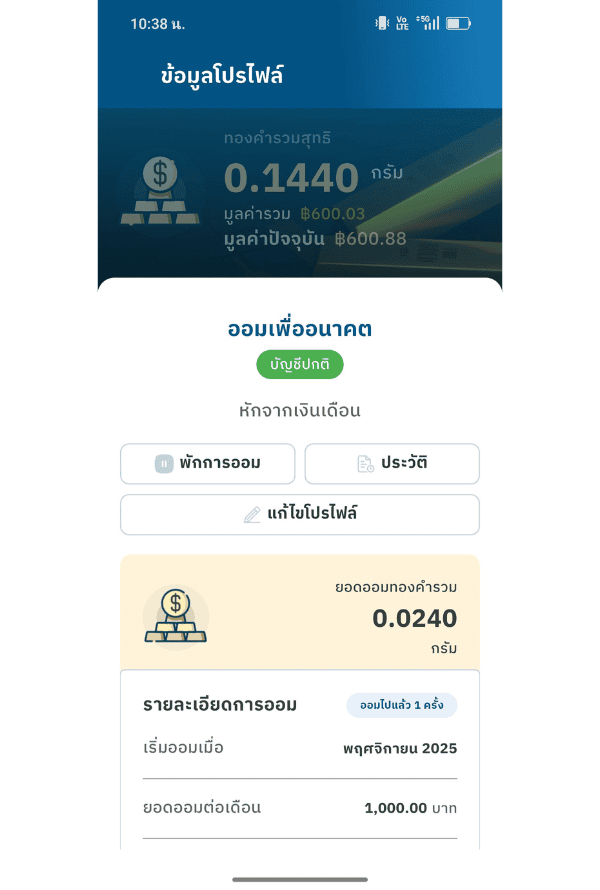

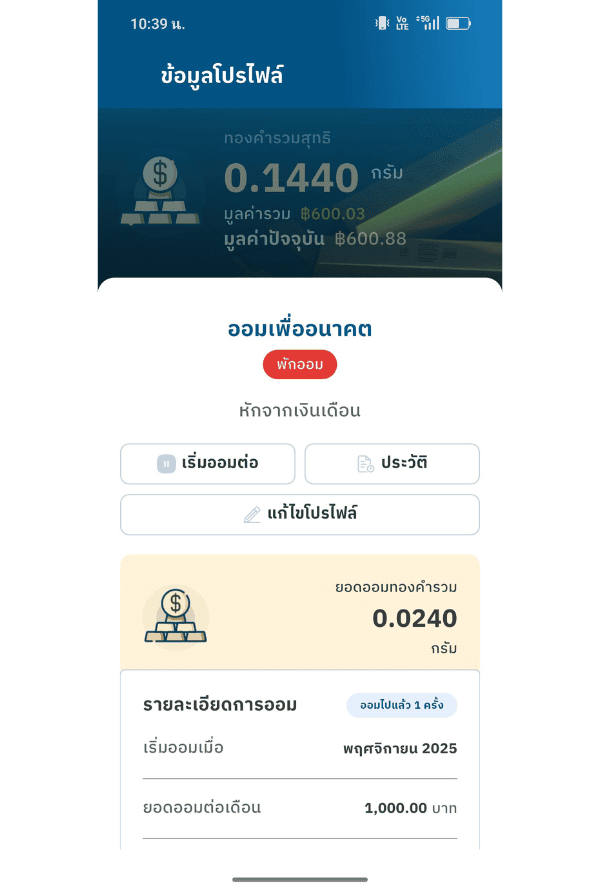

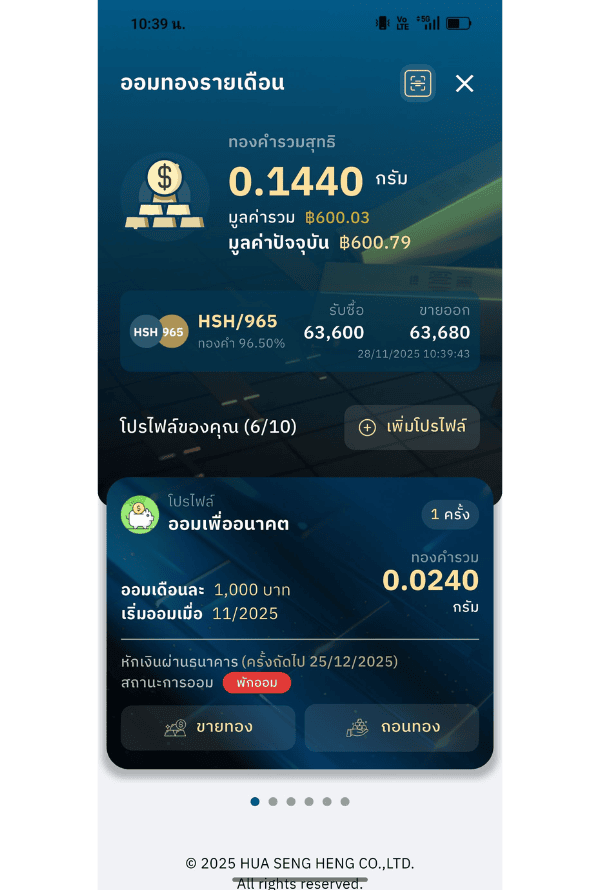

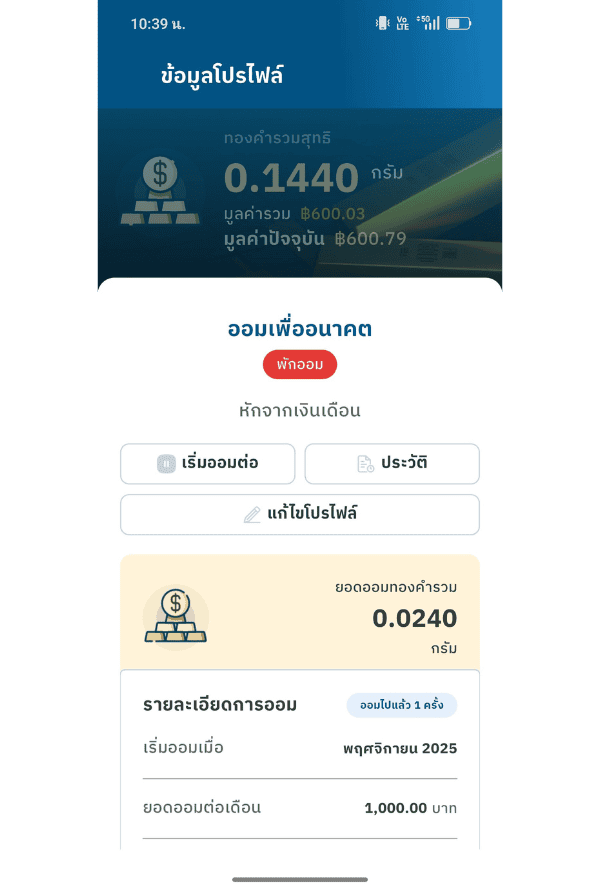

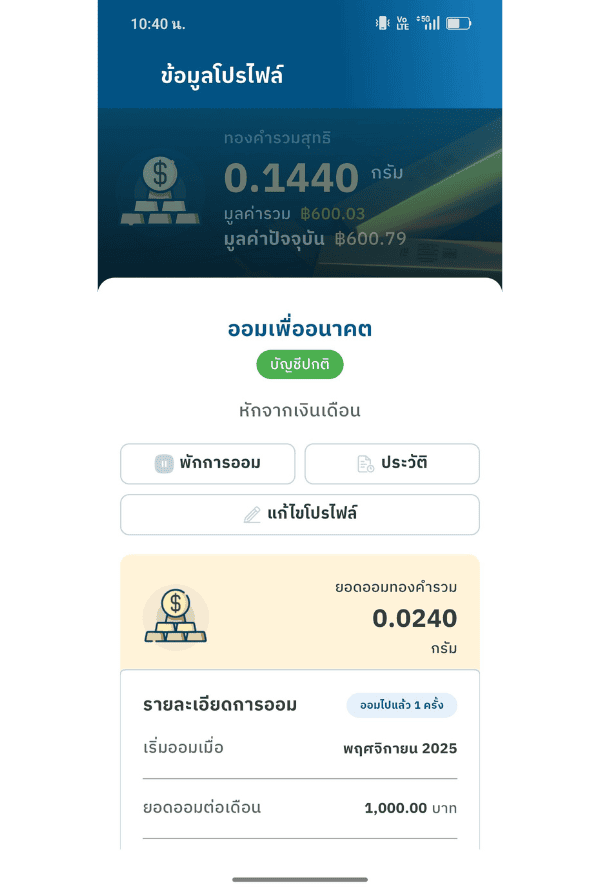

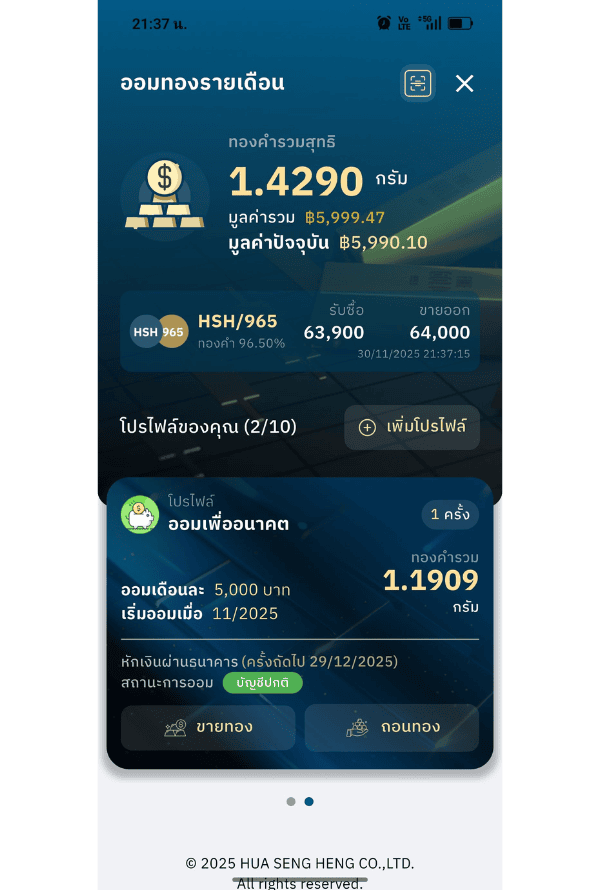

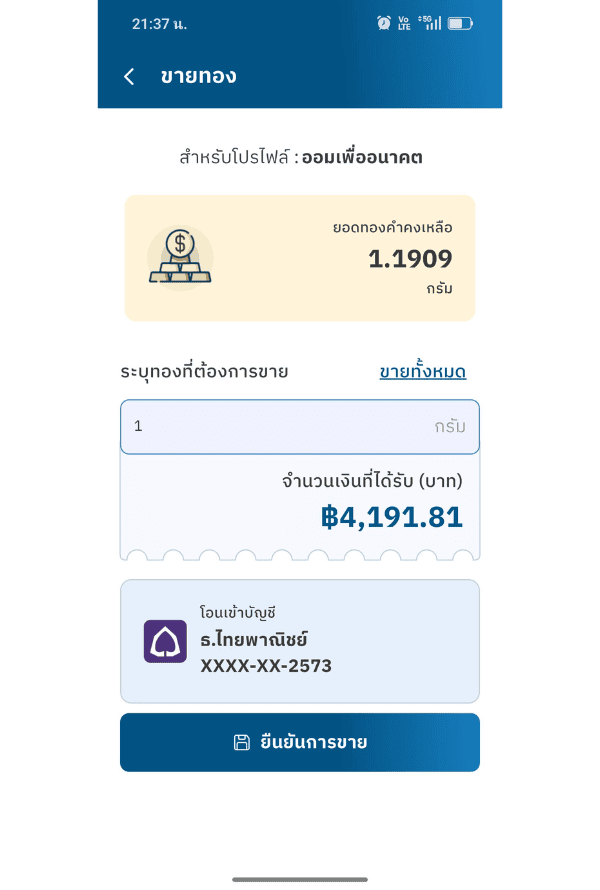

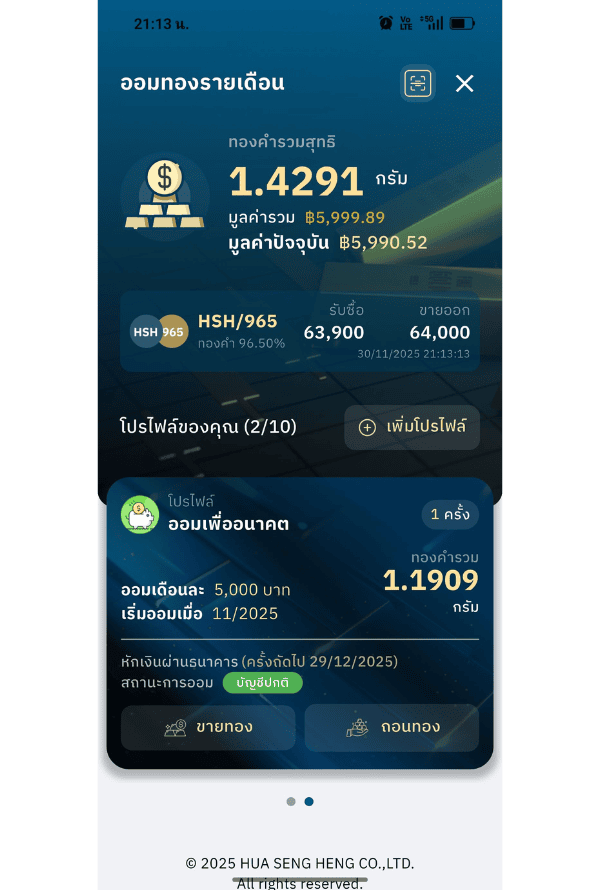

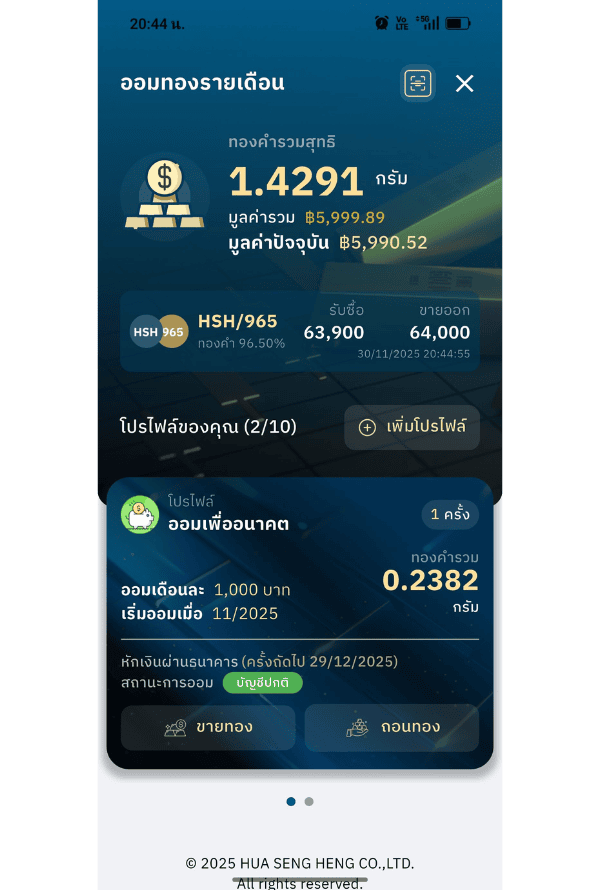

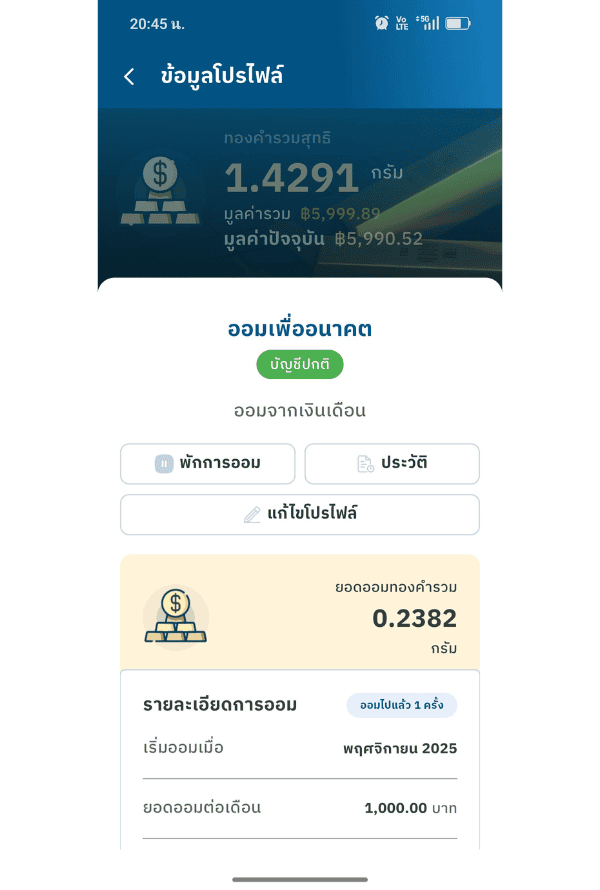

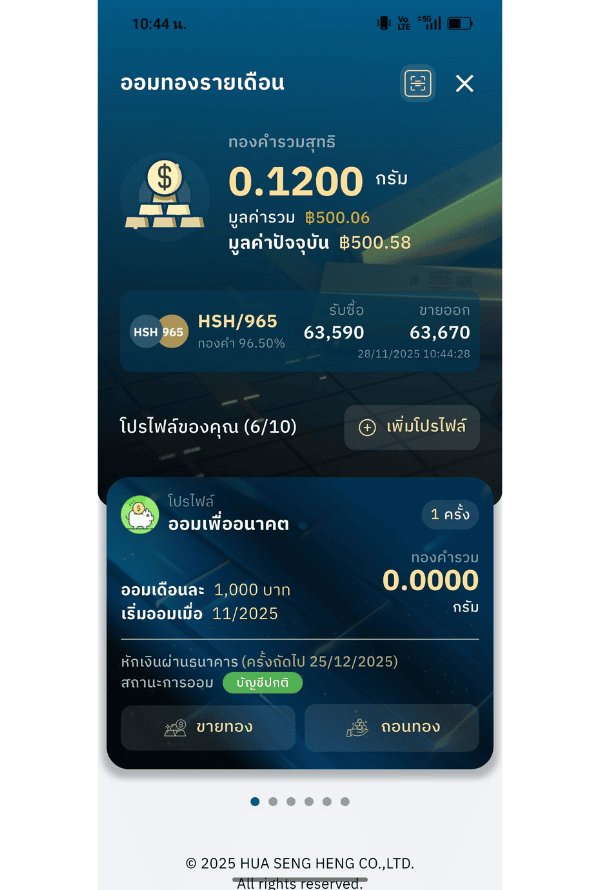

“Monthly Gold Savings” – a special feature from the GOLD NOW app

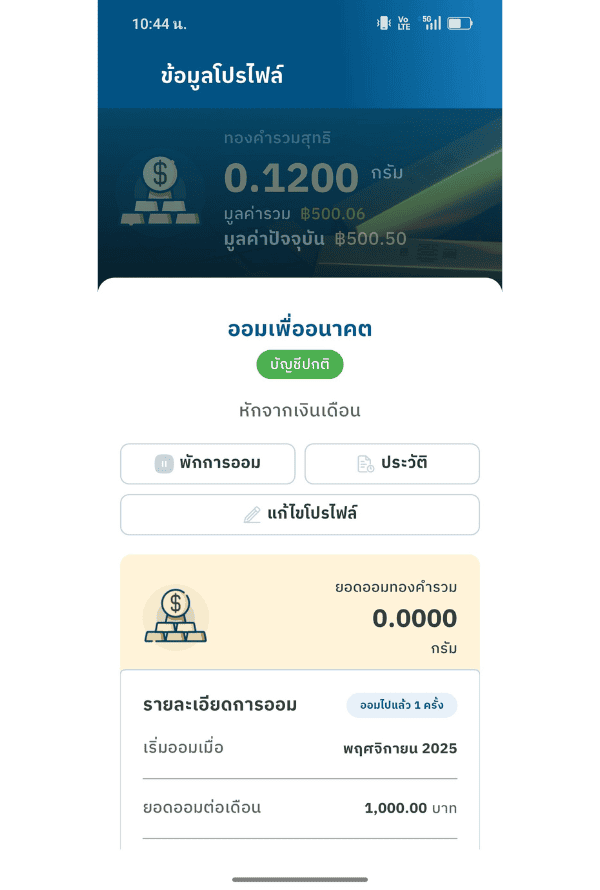

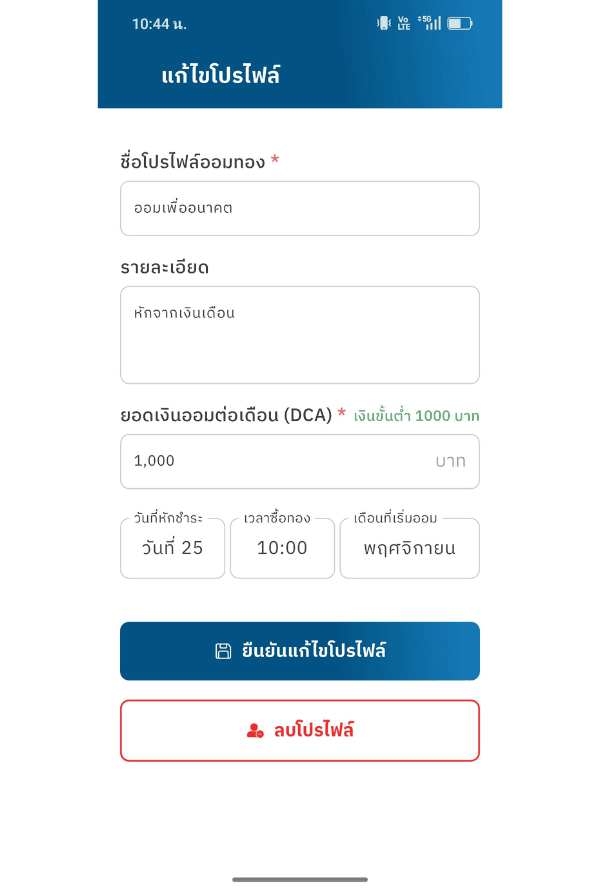

Set your preferred savings amount, starting from just 1,000 baht per month.

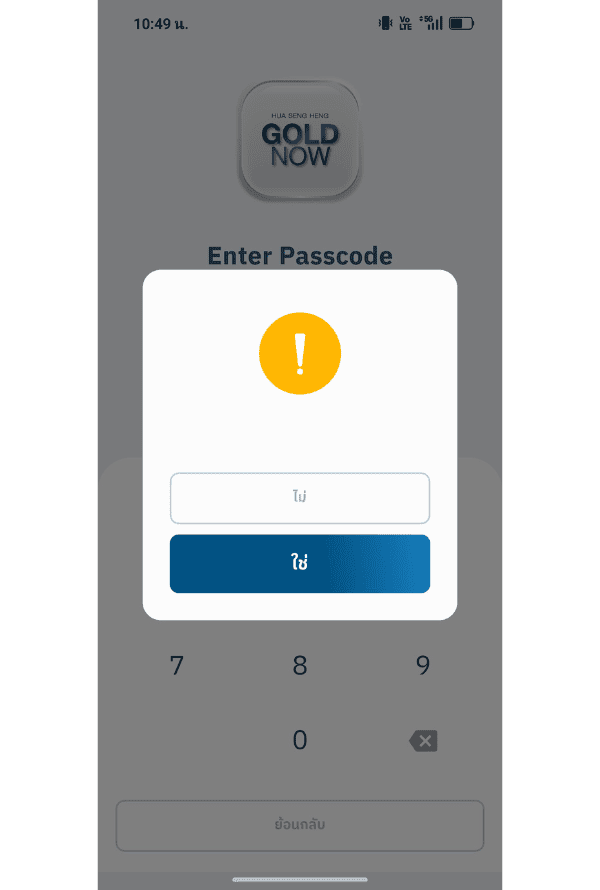

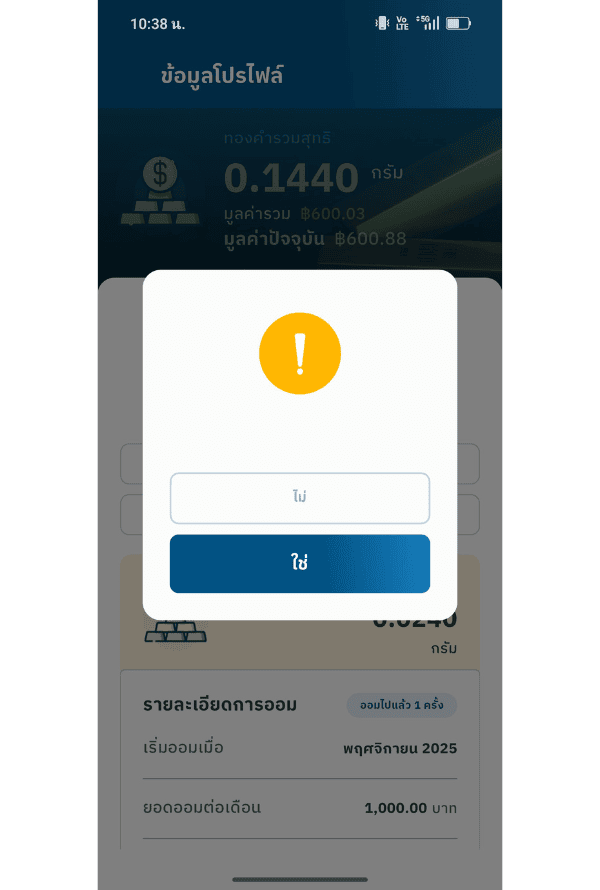

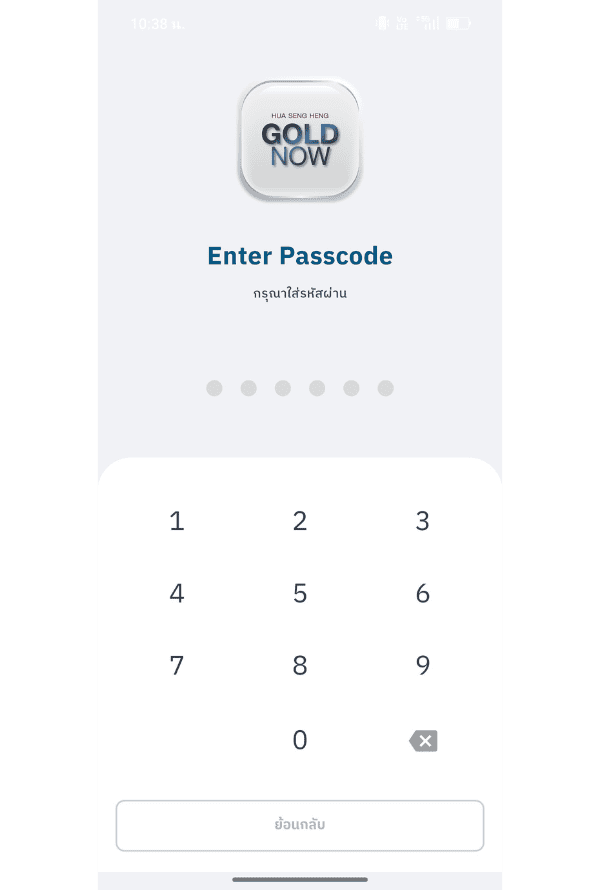

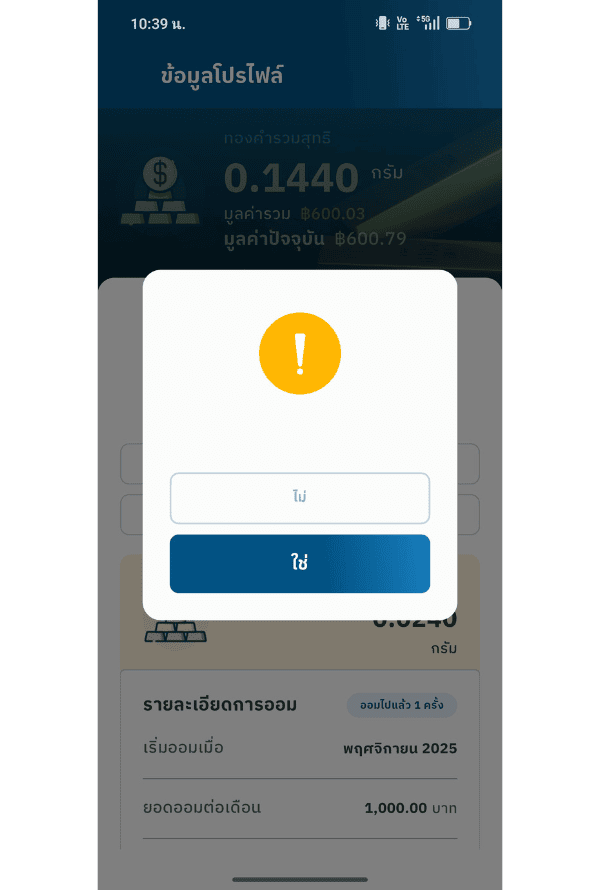

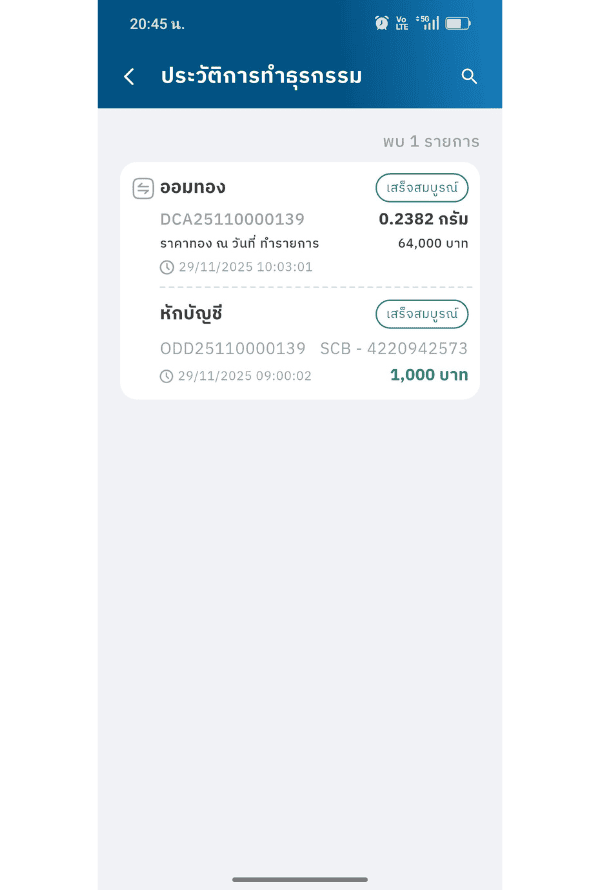

The system will automatically debit your account for gold savings every month.

Available on both iOS and Android.

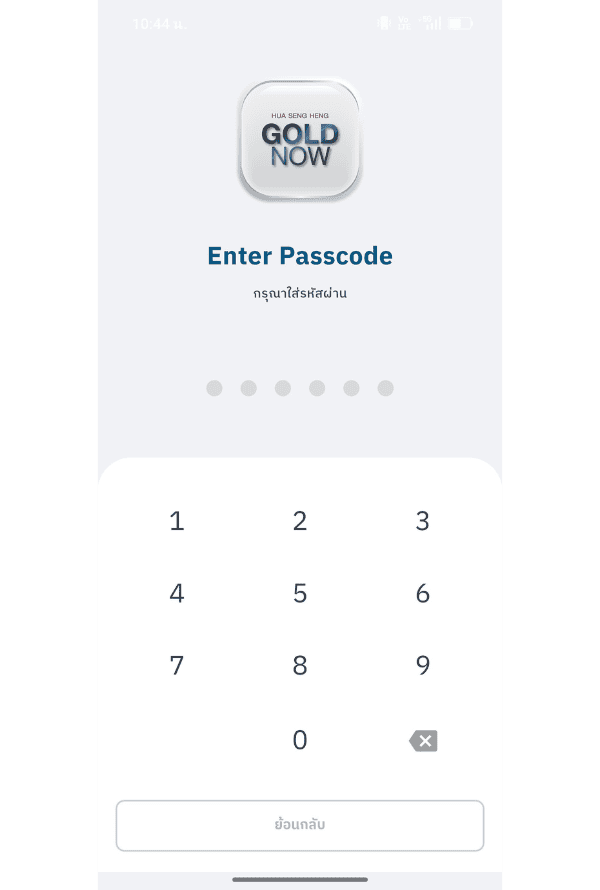

Download and sign up now.